As someone running an online business, the ability to accept payments on your website is crucial to your success. Stripe is one of the most popular payment processors used by startups and small companies. However, maintaining a healthy Stripe account can be a real challenge, especially when you're just getting started.

In this article, we'll share some helpful tips for keeping your Stripe account in good shape from Che Sampat. He's the co-founder and CEO of ChargebackStop - a company that helps online entrepreneurs manage risk and deal with the headache of chargebacks.

Che shares the best practices for integrating Stripe into your website properly and avoiding getting your account deactivated. Read this if you want to master How to avoid bans and disputes on Stripe and maintain a healthy account for a long time.

Che Sampat

Why do Stripe accounts get flagged as high-risk?

Stripe monitors accounts closely to minimize fraud risks on their network. But as a startup just getting started, it's difficult for them to initially assess the legitimacy and risk level of a completely new business with no sales history. Even minor issues early on can cause Stripe to flag the account as "high risk."

Some of the main factors that can contribute to an account being flagged include:

- Refunds and chargebacks: Early refunds or chargebacks, especially for a large percentage of orders, raise red flags as potential signs of fraudulent activity. Even a couple in the first few months can impact a new account.

- Payment declines: A high rate of declined payments, whether from blocked or expired cards, also signals a higher risk that needs review.

- Account changes: Frequent changes to business or bank account details, products/services sold, or other account settings may cause Stripe to perform extra diligence.

- Selling prohibited goods/services: Selling anything on Stripe's prohibited list is cause for instant termination regardless of sales volume. Carefully review their policies.

- Automatic risk checks: Behind the scenes, Stripe uses sophisticated algorithms and machine learning to continuously monitor patterns and automatically flag accounts that appear riskier than others.

As a newbie seller, any financial actions outside the norm potentially change how your account risk level is perceived by Stripe's automated systems. Multiple adverse incidents early on unfortunately stack the deck against the account.

Setting yourself up for success from the start

To avoid potential problems in the future, it's important to take proactive steps right from the beginning to establish trust with Stripe and develop good habits for your account. Here are some recommendations:

- Use payment options carefully: Be selective about which payment methods you enable. Adding some less-popular card providers may be a risk.

- Use strict fraud rules: Strengthen your fraud prevention rules in Stripe for new orders. This can include requiring additional security measures like 3D Secure authentication and setting higher risk thresholds. Stripe Radar is a system that helps detect and prevent fraudulent activity in your store. When you're starting out, it's a good idea to set stricter rules through Stripe Radar to reduce the risk of fraud.

- Make checkouts slightly more difficult: Include some minor obstacles during the checkout process to discourage people from making impulsive purchases with stolen cards just to test them.

- Have a flexible return policy: Make it easy for customers to process returns, refunds, and cancellations without resorting to chargebacks. Avoid chargebacks whenever possible.

- Encourage positive reviews: Offer incentives for happy customers to leave online reviews early on. This helps build social proof and shows that your business is legitimate.

- Start with small transactions: Begin with low sales volumes and charge small amounts until you've established a history of successful orders and payment patterns.

- Communicate proactively: Reach out to your Stripe representative and explain any financial actions you're taking, rather than leaving them to discover it through automated alerts.

- Review your risk settings: Compare Stripe's default settings with more restricted profiles for higher-risk categories, such as digital goods that are prone to chargebacks.

By following these practices from the beginning, you'll build trust in your account and reassure Stripe that your business is legitimate. This sets you up for long-term success right from the start.

Responding to risk flags correctly

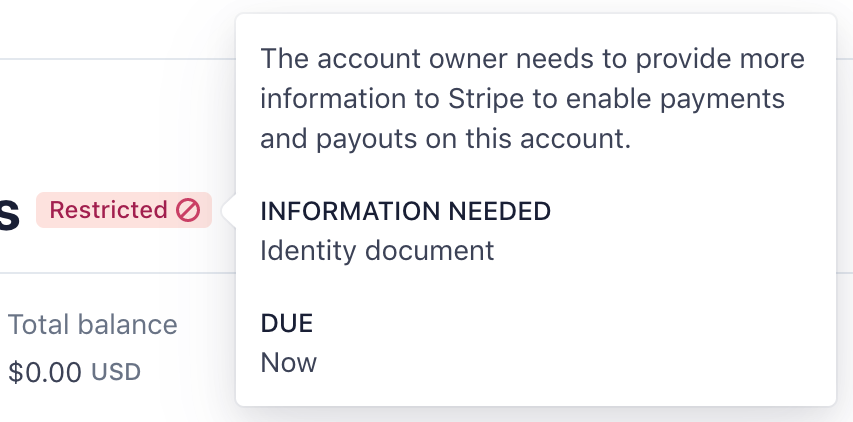

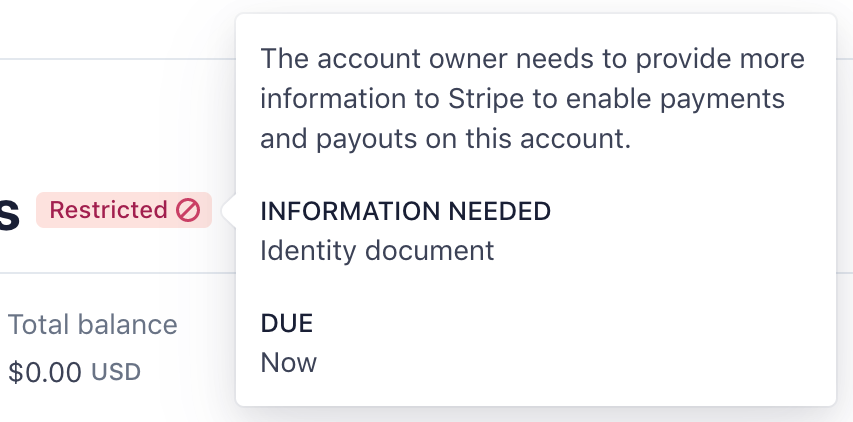

Despite your best efforts, new businesses sometimes face initial challenges like chargebacks that make them appear riskier. If Stripe limits or shuts down your account, take quick action:

- Stop all sales until the issue is resolved to prevent further exposure and liability. However, you can continue with product development and support.

- Contact Customer Support through official channels only. Avoid trying to reach out to employees on social media, as it goes against policies. Provide a detailed explanation of the situation.

- Be willing to make necessary changes, such as restricting certain products or adjusting prices, until the perceived risk level decreases naturally over time with positive sales history and reviews.

- Request an appeal or reconsideration, emphasizing that your business is a legitimate operation facing a temporary setback rather than having an inherent risk profile.

- Propose trying tighter risk settings as an intermediate step instead of outright termination if there are no compliance issues.

- Maintain regular communication and be persistent but respectful. Treat representatives politely since they want to help viable merchants.

Incase the disputes remain, and Stripe shuts down your account totally, try out other alternative payment processors like Paddle, Lemon Squeezy, PayPal, and PayPro Global if Stripe doesn't offer a compromise. Ensure that you fully comply with the requirements of the new payment processor

Strategies for managing your Stripe account

Once you have established a trusted history with your Stripe account, it's important to continue managing risks effectively. Keep a close eye on monthly reports to identify any negative trends and take immediate action to address the following issues:

- Decline/Chargeback rate: If your rate is higher than the average, it may indicate problems with your products or fulfillment process that need to be resolved promptly to prevent further issues.

- High refund percentage: Figure out why you have a high refund rate and make necessary adjustments. This could involve fixing pricing errors, addressing sizing issues, or ensuring consistency in your offerings.

- Abandoned carts: If a large percentage of customers are not completing their purchases, consider improving the checkout experience to make it easier for them to complete their purchases.

- New-To-Repeat customer ratio: If you have a lot of new customers but struggle to retain them, investigate the reasons behind it and find ways to improve customer retention.

- Average Order Value trends: Keep an eye on the average order values over time. If you notice a sustained decrease, analyze whether adjustments to pricing, product offerings, or overall customer experience are needed.

- Payment method mix: Evaluate the mix of payment methods you offer. If you heavily rely on riskier methods like card-not-present transactions, consider adding safer options such as storing cards on file or offering bank transfers.

- Geolocation risk scores: Some regions may have a higher risk of fraud. Adapt your rules and precautions based on the location to reduce these risks effectively.

- Support case volume: Pay attention to the volume of support cases. Unusual spikes may indicate issues with your service or fulfillment that require adjustments in staffing or processes.

By closely monitoring these performance metrics over time, you can identify potential risks early and take proactive measures to address them. This helps you avoid chargebacks or account issues down the line. By staying vigilant, you can maintain a healthy presence on Stripe and support the growth of your business.

Wrapping up

Managing high-risk factors and overcoming initial challenges requires patience and diligence as an online merchant. Stay committed to Stripe's conditions and continuously seek improvements in your products, processes, policies, and personnel to reduce operational and fraud risks in the long run. Building a trusted business reputation will give your payment partners confidence in the safety and success of your operations for years to come.

By prioritizing compliance from the start, new entrepreneurs can successfully launch and grow their online businesses with payment partners like Stripe.